All Categories

Featured

Table of Contents

You'll fill out an application that includes general individual info such as your name, age, etc as well as a much more detailed survey concerning your clinical background.

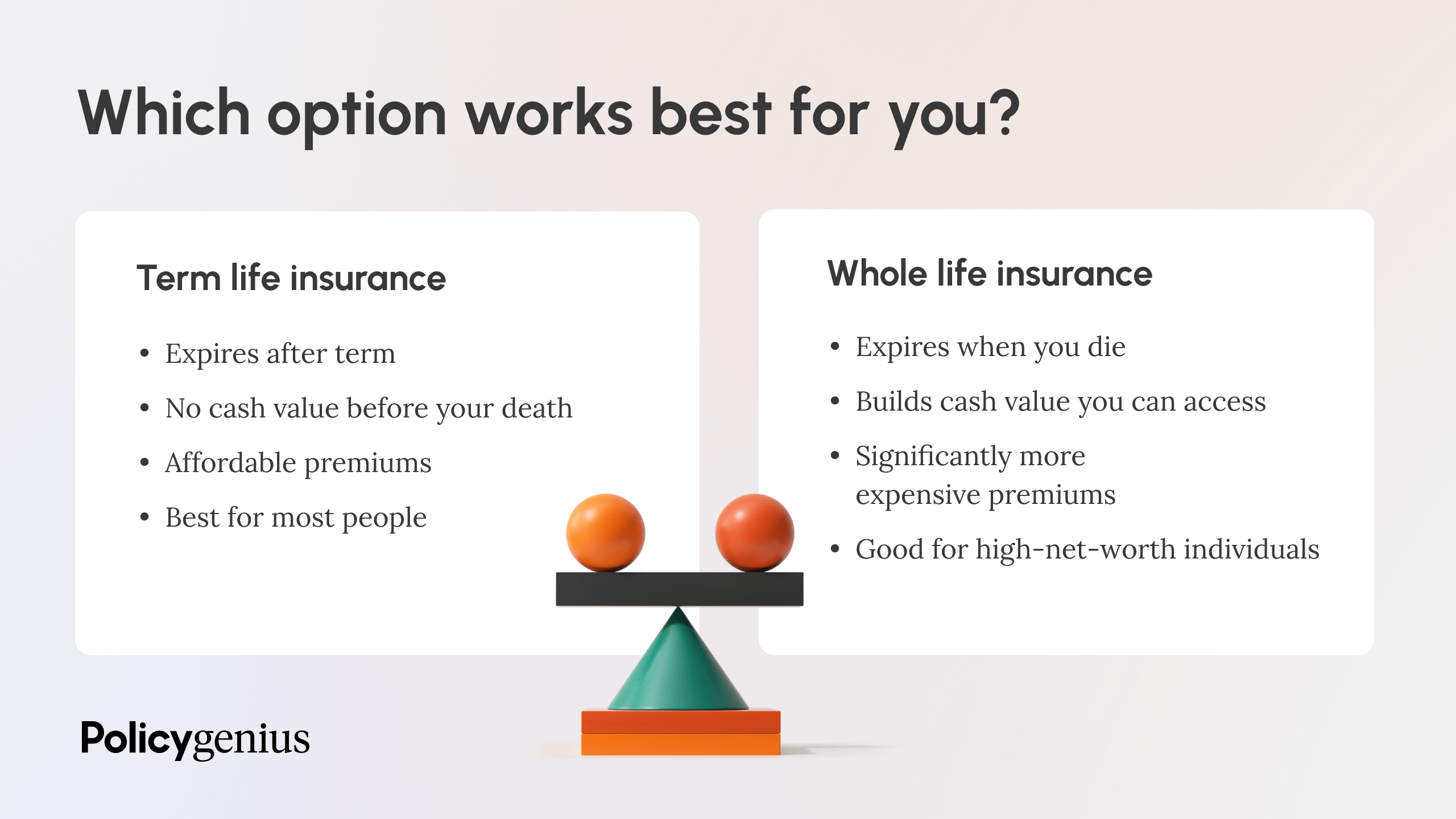

The short solution is no. A level term life insurance policy does not construct money worth. If you're looking to have a policy that you're able to take out or borrow from, you may discover long-term life insurance policy. Entire life insurance policy policies, for instance, let you have the convenience of death advantages and can accrue money worth with time, indicating you'll have more control over your advantages while you live.

Cyclists are optional stipulations included to your policy that can give you extra benefits and protections. Anything can happen over the training course of your life insurance term, and you desire to be all set for anything.

There are circumstances where these advantages are constructed right into your policy, yet they can also be readily available as a separate enhancement that calls for added repayment.

Tailored Term To 100 Life Insurance

1Term life insurance policy provides short-term defense for a vital period of time and is usually much less expensive than irreversible life insurance policy. 2Term conversion standards and restrictions, such as timing, might apply; for instance, there might be a ten-year conversion privilege for some items and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance Acquisition Choice in New York. Products and motorcyclists are readily available in accepted territories and names and functions may differ. Not all getting involved policy proprietors are eligible for returns.

(EST).2. On the internet applications for the are available on the on the AMBA website; click the "Apply Now" blue box on the right-hand man side of the page. NYSUT participants can additionally publish out an application if they would certainly prefer by clicking the on the AMBA web site; you will then need to click "Application" under "Types" on the right-hand man side of the page.

Proven Term Vs Universal Life Insurance

NYSUT participants enlisted in our Degree Term Life Insurance Policy Strategy have actually accessibility to provided at no added price. The NYSUT Participant Perks Trust-endorsed Degree Term Life Insurance Policy Plan is financed by Metropolitan Life Insurance coverage Firm and administered by Association Member Benefits Advisors. NYSUT Pupil Members are not qualified to get involved in this program.

Term life protection can last for a collection amount of time and commonly has preliminary prices that raise at set periods. Commonly, it does not build money value. Long-term life coverage, likewise called entire life insurance policy, can last your entire life and might have greater preliminary rates that do not generally enhance as you get older.

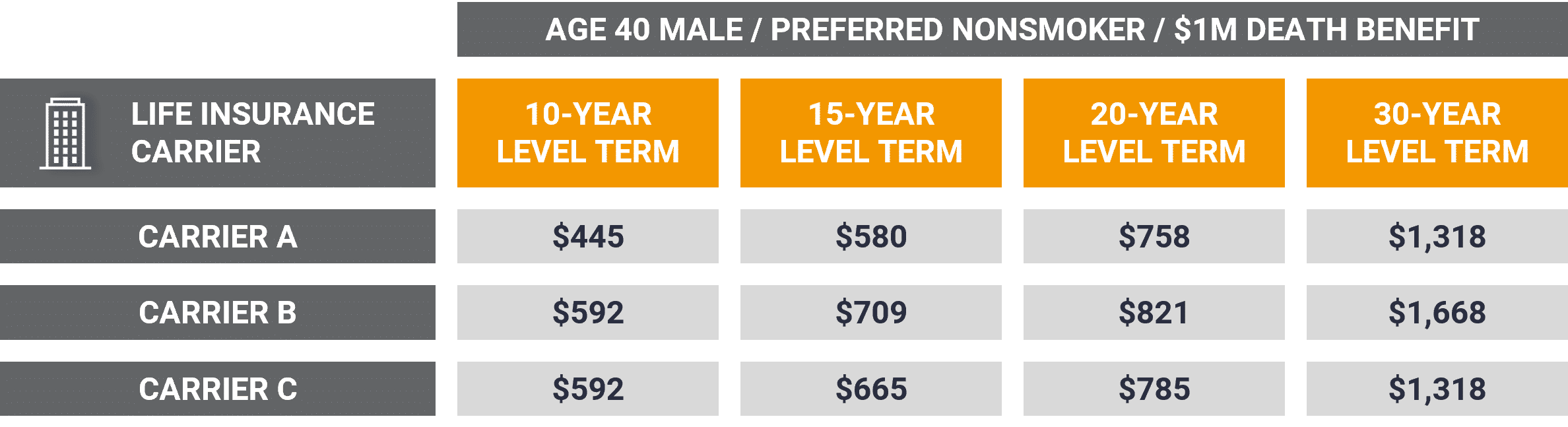

Our term life choices include 10, 15, 20, 25, 30, 35, and 40-year plans. The most popular kind is level term, meaning your repayment (costs) and payout (fatality advantage) stays degree, or the exact same, up until completion of the term period. This is the most simple of life insurance policy choices and calls for very little maintenance for policy proprietors.

As an example, you can provide 50% to your spouse and split the rest amongst your adult kids, a moms and dad, a buddy, or perhaps a charity. * In some instances the survivor benefit may not be tax-free, discover when life insurance coverage is taxed.

This is regardless of whether the insured individual passes away on the day the policy starts or the day prior to the plan finishes. To put it simply, the amount of cover is 'degree'. Legal & General Life Insurance is an instance of a degree term life insurance policy policy. A degree term life insurance plan can match a large range of situations and demands.

Your life insurance policy policy might likewise develop part of your estate, so might be based on Estate tax reviewed more regarding life insurance and tax obligation. level premium term life insurance policies. Let's consider some features of Life insurance policy from Legal & General: Minimum age 18 Maximum age 77 (Life insurance policy), or 67 (with Important Health Problem Cover)

Tailored Voluntary Term Life Insurance

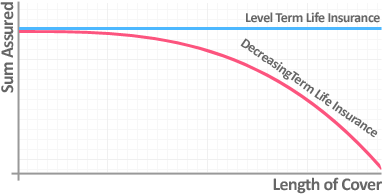

What life insurance could you take into consideration if not level term? Reducing Life Insurance Policy can aid protect a settlement mortgage. The quantity you pay stays the same, however the degree of cover lowers about according to the method a payment mortgage reduces. Reducing life insurance policy can aid your liked ones stay in the household home and prevent any additional disruption if you were to die.

You intend to make certain that the individuals that rely on your revenue are economically protected, also if something were to occur to you. Life insurance policy is a crucial means to safeguard your enjoyed ones. Level term life insurance policy is what's called a level costs term life insurance coverage policy. Primarily, that suggests you'll obtain protection that lasts for a set duration of time and the amount you pay won't transform.

A degree term life insurance policy plan can provide you satisfaction that individuals that depend on you will certainly have a fatality advantage throughout the years that you are planning to sustain them. It's a way to aid deal with them in the future, today. A level term life insurance policy (in some cases called degree premium term life insurance policy) plan gives protection for an established number of years (e.g., 10 or twenty years) while maintaining the costs payments the same for the duration of the policy.

With level term insurance, the cost of the insurance coverage will stay the very same (or possibly reduce if dividends are paid) over the regard to your plan, usually 10 or 20 years. Unlike long-term life insurance policy, which never ever ends as long as you pay costs, a level term life insurance coverage plan will end eventually in the future, usually at the end of the duration of your level term.

Exceptional Increasing Term Life Insurance

Due to the fact that of this, many individuals use irreversible insurance coverage as a steady financial planning tool that can serve numerous needs. You might be able to convert some, or all, of your term insurance policy throughout a collection period, usually the very first one decade of your policy, without needing to re-qualify for coverage also if your health and wellness has altered.

As it does, you might want to include to your insurance policy protection in the future. As this takes place, you may want to eventually reduce your fatality advantage or take into consideration converting your term insurance to an irreversible policy.

Table of Contents

Latest Posts

Funeral Policy

Mutual Of Omaha Final Expense

Funeral Plan For Over 30

More

Latest Posts

Funeral Policy

Mutual Of Omaha Final Expense

Funeral Plan For Over 30